In this article, you will find a comprehensive list of 10 Awesome Blogs For Your Personal Finance.

These blogs will cover a range of personal finance topics including budgeting, investing, debt management, retirement planning, and general financial literacy. They are popular for offering actionable advice and insights into managing money.

Table of Contents

10 Awesome Blogs For Your Personal Finance

The Penny Hoarder

The Penny Hoarder focuses on Budgeting, Side Hustles, Saving and Frugality.

It offers practical and actionable tips for everyday money management. It covers a wide range of topics, including frugal living, saving on everyday expenses, finding side hustles, and creative ways to make extra income.

As economic uncertainties, inflation, and job market changes affect millions, The Penny Hoarder helps readers find opportunities to improve their financial situation by making smarter decisions about spending and earning.

Whether you’re looking for ways to budget more efficiently, cut back on discretionary spending, or discover the best side gigs to boost your income, The Penny Hoarder provides easy-to-follow guides, real-life success stories, and expert financial advice that makes managing money feel more attainable for everyone.

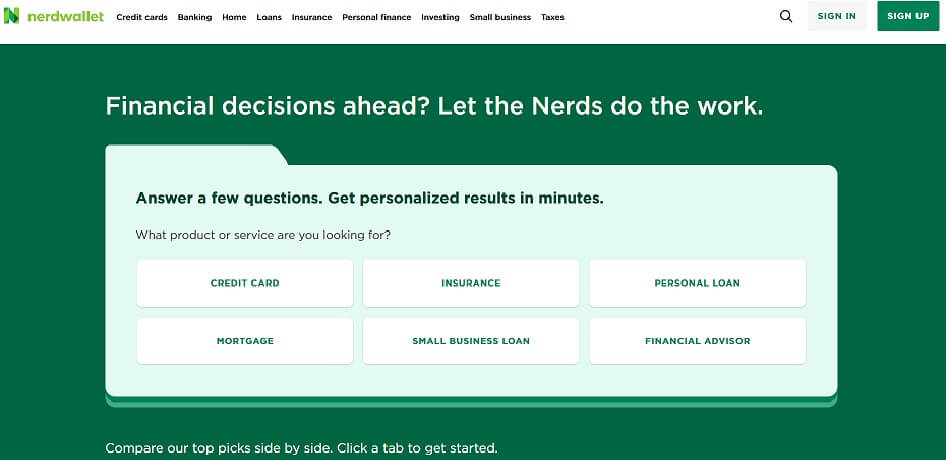

NerdWallet

The main focus of NerdWallet is on Credit Cards, Loans, Investing, Insurance and Budgeting.

NerdWallet is one of the most comprehensive and reliable resources for personal finance, offering in-depth, easy-to-understand guidance on a wide range of financial topics.

It helps users navigate the increasingly complex landscape of credit cards, loans, and insurance by providing clear comparisons and expert advice on how to choose the best financial products for their needs.

With a focus on helping people make smarter financial decisions, NerdWallet offers detailed reviews, interest rate breakdowns, and a variety of calculators for things like mortgages, car loans, and credit card rewards.

For those interested in investing, it provides resources for beginner and advanced investors alike, with market insights, stock recommendations, and investment strategies.

As personal finance continues to evolve with new fintech innovations, NerdWallet remains a crucial tool for consumers looking to save money, optimize their spending, and make informed choices when it comes to credit, insurance, and investing.

The Budget Mom

The Budget Mom blog focuses on Budgeting, Debt Elimination and Personal Finance

The Budget Mom has become an essential resource for individuals seeking to take control of their finances, particularly for those dealing with debt or looking to create a more sustainable financial future.

This blog offers actionable advice on budgeting techniques, with a focus on creating realistic, manageable budgets that fit your unique lifestyle. One of its standout features is its emphasis on debt elimination strategies, such as the debt snowball method and debt avalanche, which have helped countless readers achieve financial freedom.

The Budget Mom also provides detailed guidance on topics like saving for emergencies, setting financial goals, and prioritizing spending, making it an invaluable resource for readers at any stage of their financial journey.

Many individuals are looking for ways to cope with rising inflation and financial uncertainty. The Budget Mom’s practical, step-by-step advice, as well as her downloadable budget worksheets and planners, are perfect for anyone aiming to build a solid financial foundation.

Frugalwoods

Frugalwoods is a blog that focuses on Financial Independence, Frugality and Sustainable Living.

Frugalwoods is a blog that promotes the philosophy of frugality and financial independence through simple living, conscious spending, and long-term wealth-building.

The blog’s founders, Liz and Nate, share their journey of achieving financial independence by making intentional choices about their lifestyle, from downsizing their living expenses to prioritizing savings and investments.

Frugalwoods offers practical advice on cutting costs without sacrificing quality of life, making it a great resource for those looking to live more sustainably, both financially and environmentally.

As more people become interested in reducing their carbon footprint and simplifying their lives, Frugalwoods’ focus on living intentionally and consciously managing finances resonates strongly in 2025. It includes actionable tips on budgeting, minimalist living, and achieving financial freedom at a young age, all while promoting a balanced approach to work, life, and money.

This blog is especially valuable for readers looking to pursue the Financial Independence, Retire Early (FIRE) movement while maintaining a meaningful and frugal lifestyle.

The Motley Fool

The Motley Fool is a renowned American financial services company founded by ‘Tom Gardner’ that has been a trusted resource for personal finance and investing since its founding in 1993.

Known for its engaging and accessible approach, The Motley Fool offers expert investment advice, stock recommendations, and financial planning insights through its blog, newsletters, podcasts, and premium services.

It targets both beginner and experienced investors, with a focus on long-term wealth-building strategies rather than short-term trading.

The Motley Fool’s popular stock analysis, paired with its emphasis on financial education, has attracted millions of subscribers who seek unbiased, actionable insights into stock market investing, retirement planning, and personal finance management.

Its community-driven model and passionate user base make it one of the most influential and respected voices in the financial world.

Money Saving Mom

Money Saving Mom, founded by Crystal Paine in 2007, is a highly popular personal finance blog that focuses on helping individuals and families save money, budget effectively, and live frugally.

Paine, who is passionate about finding ways to save on everyday expenses, shares practical tips on couponing, meal planning, budgeting, and finding the best deals.

The website features a mix of content, including money-saving tips, deals of the day, and DIY strategies, all geared toward empowering readers to take control of their finances.

It has a strong following among moms, particularly those looking to stretch their household budgets while still enjoying a fulfilling lifestyle.

In addition to saving money, the site often covers topics related to parenting, homemaking, and organizing.

With a large and engaged audience, Money Saving Mom offers free resources like pintables, budgeting tools, and challenges to help readers reach their financial goals.

How to Money

How to Money is a popular personal finance blog and podcast founded by Joel and Matt, two friends who are passionate about simplifying personal finance and making financial literacy more approachable for everyone. The blog covers a wide range of topics, from budgeting and saving to investing and earning more money.

What sets How to Money apart is its informal, fun, and conversational tone, making complex financial topics easier to digest for readers of all backgrounds. In addition to practical advice, they also share real-life stories and insights, often providing tips for young adults and millennials who are navigating their early financial journeys. With a strong focus on financial empowerment, the website offers resources like money challenges, actionable strategies, and budgeting tools.

The How to Money Podcast complements the blog by featuring interviews with financial experts, entrepreneurs, and everyday people who share their personal financial experiences.

Together, the blog and podcast attract a wide audience, particularly those looking for an accessible way to improve their financial habits without feeling overwhelmed.

Ruth Soukup

Ruth Soukup, a renowned author, entrepreneur, and speaker, offering a wealth of resources designed to help people live simpler, more intentional lives while achieving financial freedom.

The website is a hub for Ruth’s insights on personal finance, goal-setting, productivity, and self-improvement, aimed at empowering individuals to take control of their finances and live with purpose.

It features actionable advice on budgeting, money management, and creating a life of financial independence, often geared toward moms, entrepreneurs, and those looking to live below their means without sacrificing happiness.

Ruth’s content includes blog posts, courses, tools like the “Living Well Planner”, and books such as “Living Well, Spending Less” and “How to Blog for Profit (Without Selling Your Soul)”, all providing readers with practical steps to improve their financial and personal well-being.

The website also offers online programs for aspiring bloggers and entrepreneurs, sharing Ruth’s expertise in turning passions into profitable businesses.

With a focus on empowerment and actionable results, RuthSoukup.com is a go-to resource for anyone seeking to live a more purposeful, financially free life.

The Frugal Girl

“The Frugal Girl” is a personal finance blog created by Kristen, a passionate advocate for living frugally while maintaining a fulfilling lifestyle.

Since 2007, Kristen has been sharing her journey of saving money through practical strategies like meal planning, grocery shopping, couponing, and cutting unnecessary household expenses.

Her blog features a blend of money-saving tips, budget-friendly recipes, and thoughtful reflections on minimalism and living simply.

Kristen emphasizes the importance of making intentional, mindful choices rather than just extreme frugality, encouraging readers to prioritize what really matters in life.

The blog’s popular features include “Monday Meals” (a weekly roundup of her family’s meal plan), budget grocery hauls, and tips for making the most of everyday purchases.

In addition to practical financial advice, The Frugal Girl fosters a sense of community by engaging with readers and encouraging them to share their own money-saving ideas and stories.

The blog’s relatable, down-to-earth approach makes it a trusted resource for families, individuals, and anyone looking to live a more frugal yet enriching life.

Smart Passive Income

Smart Passive Income, created by Pat Flynn, is a blog dedicated to helping people build passive income streams through online businesses.

Pat shares his personal experiences and strategies on how to make money online in a way that doesn’t require constant active effort.

The blog covers a wide range of topics, from creating and selling online courses and building email lists, to starting podcasts and monetizing websites. It’s particularly focused on transparency, with Pat openly discussing his income reports, successes, and failures.

This candid approach makes it a trusted resource for those looking to create sustainable income with less reliance on traditional 9 to 5 jobs.

Conclusion

Staying informed and proactive about personal finance is crucial to achieving financial stability and success.

The blogs mentioned here offer valuable insights, actionable tips, and expert advice to help you navigate the complexities of money management.

Whether you’re looking to save more, invest wisely, or simply understand the basics of personal finance, these resources can serve as your go-to guides on the journey toward financial independence.

So, make sure to explore these blogs regularly and continue building a solid foundation for your financial future.

You may also like,

5 Proven Strategies To Boost Affiliate Income